By: Brian Nosek, Center for Open Science

In the Fall of 2011, Sarah Mackenzie, the maid of honor at my wedding, was diagnosed with a rare form of ovarian cancer. Sarah and her family were motivated to learn as much as they could about the disease to advocate for her care. They weren’t scientists, but they started searching the literature for relevant articles. One evening, Sarah called us, angry. Every time she found an article that might be relevant to understanding her disease, she ran into a paywall requiring $15-$40 to access it. Public money had paid for the research, yet she was barred from making any use of it. Luckily, she had us. Most people in Sarah’s position don’t have the luxury of friends at wealthy academic institutions with subscriptions to the literature.

In the Fall of 2011, Sarah Mackenzie, the maid of honor at my wedding, was diagnosed with a rare form of ovarian cancer. Sarah and her family were motivated to learn as much as they could about the disease to advocate for her care. They weren’t scientists, but they started searching the literature for relevant articles. One evening, Sarah called us, angry. Every time she found an article that might be relevant to understanding her disease, she ran into a paywall requiring $15-$40 to access it. Public money had paid for the research, yet she was barred from making any use of it. Luckily, she had us. Most people in Sarah’s position don’t have the luxury of friends at wealthy academic institutions with subscriptions to the literature.

During this time, I was pursuing an interest in the business models of scholarly communication. I wanted to understand the ways in which these models interfered with the dissemination of knowledge that could improve quality of life. Sarah’s experience illustrated one key part of the problem–the outcomes of research should be public goods, but the business models of publishing make them exclusive goods. Lack of access to published literature limits our ability to apply what we know to improving others’ quality of life. If doctors can’t access the literature, they can’t keep up with the latest innovations for care. If policy makers can’t access the literature, they can’t create evidence based policies. To advance solutions and cures, the outcomes of research must be open.

Submit your manuscripts to the Journal of The Electrochemical Society (JES)

Submit your manuscripts to the Journal of The Electrochemical Society (JES)  The following is a roundup of the top articles published on the ECS Redcat Blog in 2017.

The following is a roundup of the top articles published on the ECS Redcat Blog in 2017. New research from Sandia National Laboratory is moving toward advancing solid state lithium-ion battery performance in small electronics by identifying major obstacles in how lithium ions flow across battery interfaces.

New research from Sandia National Laboratory is moving toward advancing solid state lithium-ion battery performance in small electronics by identifying major obstacles in how lithium ions flow across battery interfaces. Scientists have found a way to make their asphalt-based sorbents better at capturing carbon dioxide from gas wells: Adding water.

Scientists have found a way to make their asphalt-based sorbents better at capturing carbon dioxide from gas wells: Adding water. Each year, the ECS Canada Section recognizes a deserving PhD student from a Canadian university for academic achievements in our multi-disciplinary fields though the

Each year, the ECS Canada Section recognizes a deserving PhD student from a Canadian university for academic achievements in our multi-disciplinary fields though the  Carbon dioxide accounts for over

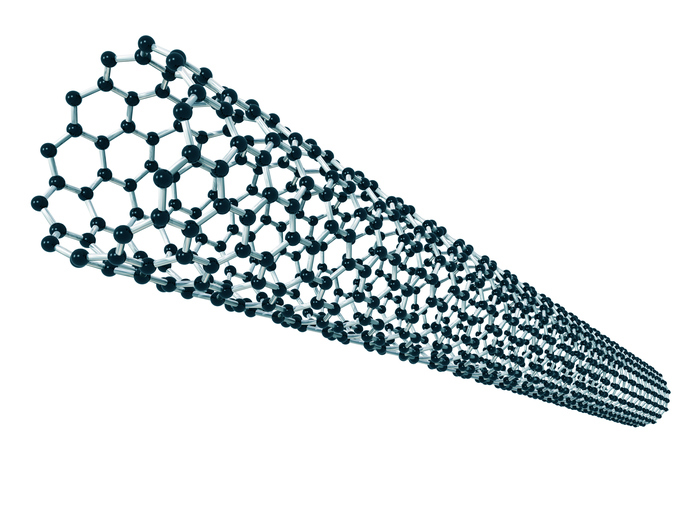

Carbon dioxide accounts for over  The introduction of purified carbon nanotubes appears to have a beneficial effect on the early growth of wheatgrass, according to scientists. But in the presence of contaminants, those same nanotubes could do great harm.

The introduction of purified carbon nanotubes appears to have a beneficial effect on the early growth of wheatgrass, according to scientists. But in the presence of contaminants, those same nanotubes could do great harm.